unemployment tax credit refund 2021

Yes for 2021 and ONLY 2021 if you collect unemployment your income will be considered as 133 of the Federal Poverty Level for purposes of calculation the Premium Tax Credit regardless of your actual income. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

Here Are Some Last Minute Tax Tips Ahead Of The April 18 Deadline The Washington Post

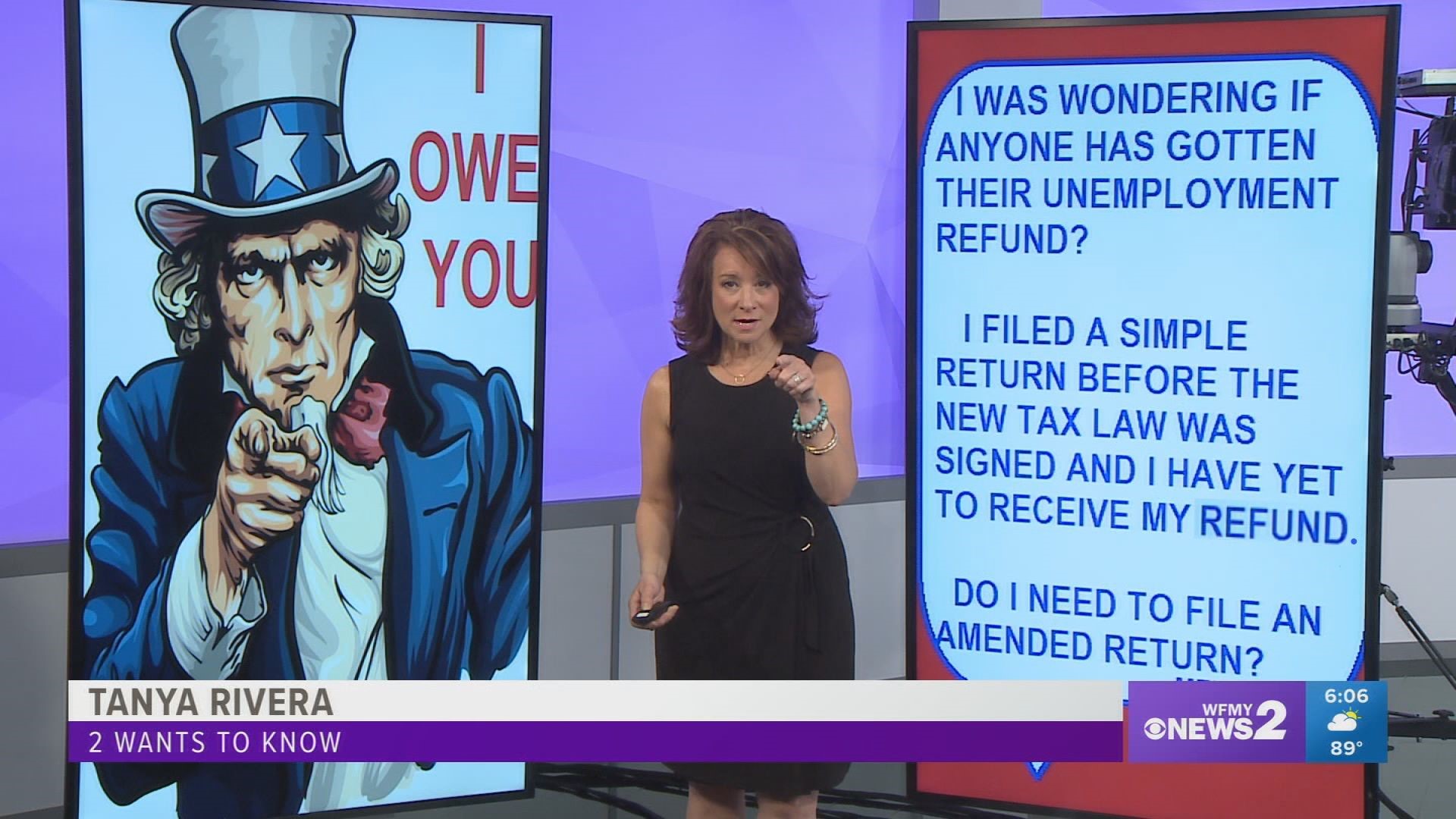

The IRS identified over 10 million taxpayers who filed their tax returns prior to the.

. Unemployment Tax Refund Still Missing You Can Do A. As of Nov. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax.

Another thing the American Rescue Plan did was exempt up to 10200 of unemployment compensation from taxes for the 2020 tax year. The American Rescue Plan Act of 2021 excluded up to 10200 of 2020 unemployment compensation from taxable income calculations. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020.

In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. They fully paid and paid their state unemployment taxes on time.

Unemployment tax credit refund 2021. Angela langcnet june started with the irs sending 28 million refunds to those who received unemployment benefits in 2020 and paid taxes on jobless benefits this year. The agency sent about 430000 refunds totaling more than 510 million in the last batch issued around.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. If both members of a married couple were receiving unemployment they could both deduct up to that amount. Special rule for unemployment compensation received in tax year 2020 only The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only.

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund. The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to 10200 of unemployment benefits on their 2020 tax return. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

The IRS plans to issue another tranche of refunds before the end of the year. IR-2021-212 November 1 2021. The 10200 amount 20400 for joint filers is how much 2020 unemployment compensation doesnt count as income.

This exclusion was applied to individuals and married couples whos modified adjusted gross income was less than 150000. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. Data is seasonally adjusted and through Dec 25 2021.

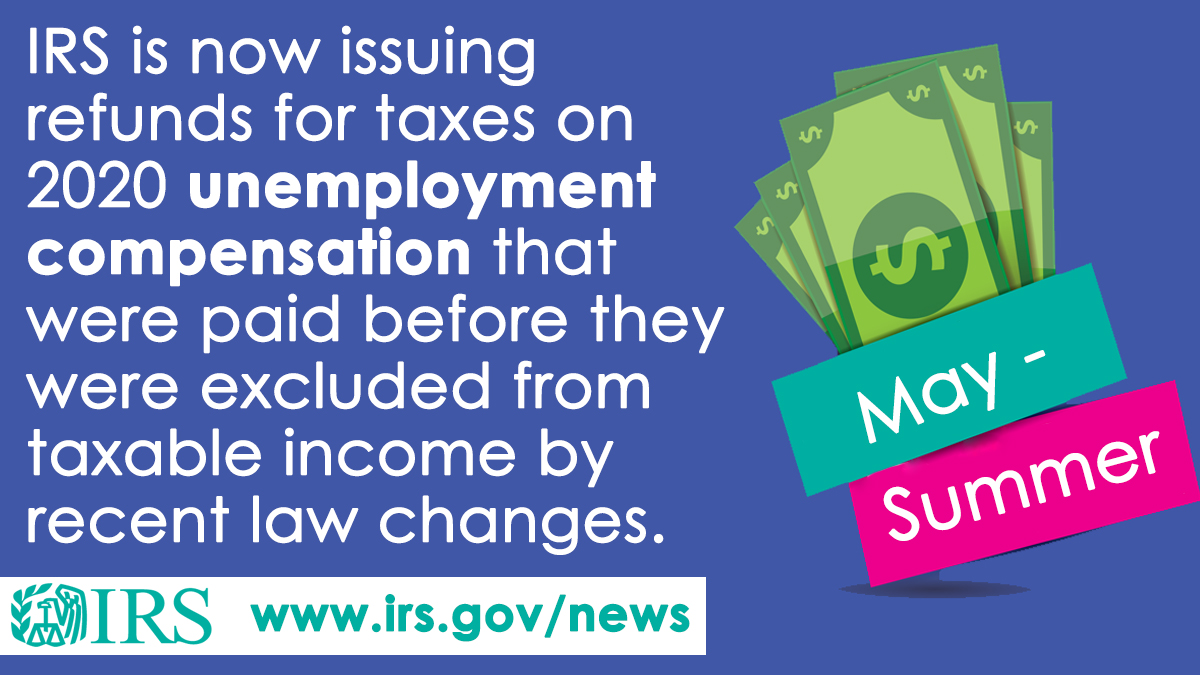

WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment compensation that the recently-enacted American Rescue Plan later excluded from taxable income. ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

Jobless workers who collected benefits the first year of the. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. Premium federal filing is 100 free with no upgrades for premium taxes.

Your employer on the other hand may be eligible for a credit of up to 54 of FUTA taxable wages if. Saturday May 14 2022. IR-2021-159 July 28 2021.

Getty What are the unemployment tax refunds. The exemption which applied to federal taxes meant that unemployment checks. This is the latest round of refunds related to the added tax exemption for the first 10200 of.

Congress hasnt passed a. So if you fit the criteria above you may be on the list of taxpayers eligible for the tax return. In late may the irs started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the provision.

Ad File your unemployment tax return free. 1 You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

In the March 11th Covid-relief American Rescue Plan Congress made up to 10200 of 2020 unemployment benefits nontaxable for individuals and married couples whose modified adjusted gross income. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Households qualified for the federal waiver if their income minus benefits was under 150000.

You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7. TAS Tax Tip. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such.

Households who are waiting for unemployment tax refunds can check the status of the payment Credit. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. The IRS efforts to correct unemployment compensation overpayments will help most of the affected.

You did not get the unemployment exclusion on the 2020 tax return that you filed. Unpaid child support could also keep you from getting the money. This isnt the refund amount.

From 2021 the FUTA tax rate is 60 and it applies to the first 7000 in annual wages paid per employee. July 29 2021 338 PM. More 2021 unemployment compensation exclusion adjustments and refunds in some cases coming The IRS reported that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust taxable income amounts based on the exclusion for unemployment compensation from previously filed income tax returns.

Like all tax refunds it can be seized if you have unpaid taxes outstanding federal or state. The 150000 limit included benefits plus any other sources of income. 22 2022 Published 742 am.

Exclusion of up to 10200 of Unemployment Compensation for Tax Year 2020 Only If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of unemployment compensation paid in 2020. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund taxpayers who are married and filing jointly could be eligible for a 20400 tax break. IR-2021-111 May 14 2021.

100 free federal filing for everyone.

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

Irsnews On Twitter Irs Is Correcting Tax Returns For Unemployment Compensation Income Exclusion The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns This Could Result In Refunds For

Why Tax Refunds Are Taking Longer Than Usual

How To Claim Your 10 200 Unemployment Tax Break If You Already Filed Taxes Stock Market Online Trading Online Stock Trading

More Of Those Surprise Tax Refunds Go Out This Week The Irs Says Will You Get

3 Big Issues Could Delay Your Tax Refund In 2022 What To Know

Where S My Refund Taxpayers Still Waiting For 2020 Irs Return Abc11 Raleigh Durham

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Abc10 Com

Irs Announces More Than 1 5 Billion Of Unclaimed Tax Refunds For 2016 Tax Year The Irs Announced That More Than 1 5 Billi Tax Attorney Paid Leave Tax Refund

Irs Tax Refund What To Do If You Didn T Receive Letter 6475 Marca

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Irs Sending Out Unemployment Tax Refunds For Those Who Overpaid Youtube

Are You To Blame For Delay In Unemployment Tax Refunds The National Interest

Irs Unemployment Tax Refunds 4 Million More Going Out This Week Abc10 Com

When Will You Get Your 2021 Income Tax Refund Cpa Practice Advisor

The Irs Has Sent Nearly 58 Million Refunds Here S The Average Payment

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

2021 Unemployment Benefits Taxable On Federal Returns King5 Com